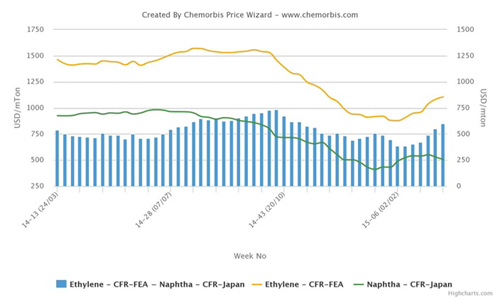

Players in both China and Southeast Asia have reported seeing significant decreases in PET prices over the past week, with players attributing the decline to significant losses in spot prices for PTA and MEG feedstock, as per the pricing service of ChemOrbis. Buying interest is said to be limited as converters are complaining of slower than expected demand ahead of the summer season while adding that they are hesitant to purchase in large amounts owing to the uncertain outlook on the market direction.

“We reduced our export prices by $100/ton this week while also cutting our prices to the local market by CNY700/ton ($110/ton),” reported a source from a Chinese producer. “Chinese origins remain more competitive than Korean origins but we still had to concede to some additional discounts of around $10/ton to conclude deals,” the source added.

“PET prices moved lower this week and we believe they will continue to soften over the near term due to lackluster downstream demand. In addition, sufficient local supplies are also maintaining downward pressure on the market,” reported a converter manufacturing plastic soft drink bottles.

“We reduced our prices to the local market by CNY500/ton ($78/ton) on the week. We had been planning to replenish our stocks last week, but for now we are maintaining our inventory at low levels,” a Chinese distributor reported. A source at a Chinese producer told ChemOrbis, “We lowered our export prices by $100/ton this week while cutting our local prices by CNY500/ton ($78/ton). Based on lackluster demand and sufficient supply levels, we expect to see additional price reductions next week.”

Players in Southeast Asia also reported seeing noticeable reductions in PET prices influenced no doubt by the falling Chinese offers, which are now duty free in the region as of this year, says ChemOrbis. “We received an import offer for Chinese PET at prices $100/ton lower than last week. We had been thinking of replenishing some stocks in the previous week but are happy that we did not ultimately purchase material,” reported a distributor in Thailand.

A converter in Vietnam commented, “PET prices are on a downward trend for now and we are waiting to see another $100/ton reduction in import prices before purchasing.”

Another PET converter in Malaysia stated that they purchased some locally-held Chinese material for testing purposes this week. “We also purchased a small amount of material from our regular sources in order to maintain good relations with our suppliers,” the buyer added.