Oil dropped for a second day in New York on signs U.S. economic growth may slow, while price swings intensified on concern the death of Osama bin Laden will lead to retaliatory attacks.

Futures fell as much as 0.7 percent today after the Institute for Supply Management’s manufacturing index declined. U.S. crude stockpiles rose for a second week, according to analysts surveyed by Bloomberg News, before an Energy Department report tomorrow. Oil options volatility increased after the al- Qaeda leader was killed in Pakistan.

“The manufacturing sector in the U.S. has been the one area that has been fast-recovering so any signs that it might not be recovering as quickly as expected is going to dampen the outlook for growth,” said Ben Westmore, a minerals and energy economist at National Australia Bank Ltd. in Melbourne. “There was some sort of terror premium factored into the oil price but, given the threat of reprisal, that hasn’t changed much.”

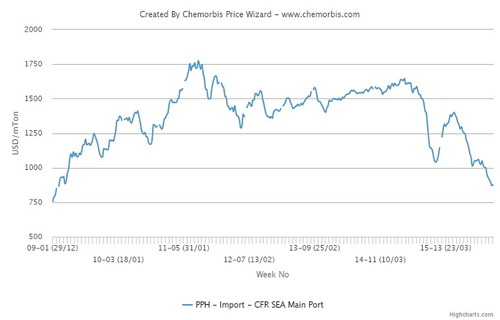

Oil for June delivery slipped as much as 77 cents to $112.75 a barrel in electronic trading on the New York Mercantile Exchange. The contract was at $112.93 at 11:45 a.m. Singapore time. Yesterday, it lost 41 cents, or 0.4 percent, to $113.52, after earlier rising as high as $114.83. Prices are up 31 percent the past year.

Brent crude for June settlement traded at $124.60 a barrel, down 52 cents, on London’s ICE Futures Europe Exchange. It fell 77 cents, or 0.6 percent, to $125.12 yesterday.

Oil Volatility

Oil in New York yesterday declined as much as 2.7 percent, the most in two weeks, after bin Laden was killed, then climbed to the highest since Sept. 22, 2008. Implied volatility for at- the-money options expiring in June, a measure of expected price swings in futures and a gauge of options prices, was 28 percent today, up from 26.2 percent April 29.

“Following the initial emotional response to Bin Laden’s death, markets soon snapped back to reality,” economists at Australia & New Zealand Banking Group Ltd. led by Warren Hogan wrote in a note today. “There are now concerns that retaliatory attacks could occur, and this has seen oil prices recoup most of their early losses.”

Bin Laden encouraged attacks on oil facilities as a way to damage the U.S. and European economies. Crude infrastructure in Saudi Arabia, holder of the world’s largest reserves, was targeted by al-Qaeda from 2002 as it sought to bring down the ruling al-Saud family. Saudi Arabian forces foiled the biggest attempted attack in 2006 on the Abqaiq oil-processing center, which handles two-thirds of the kingdom’s supply.

Longest Winning Streak

Crude has climbed this year as unrest in the Middle East and North Africa toppled leaders in Egypt and Tunisia and spread to Libya, Algeria, Bahrain, Iran, Oman, Yemen and Syria. Oil in New York has increased for eight straight months, the longest winning streak on record.

Brent, the European benchmark, traded at a premium of $11.60 a barrel to U.S. futures yesterday. The difference between front-month contracts in London and New York surged to a record $19.54 on Feb. 21. The spread averaged 76 cents last year.

An Energy Department report tomorrow may show crude supplies climbed 3 million barrels from 363.1 million last week, according to the median of seven analyst estimates in a Bloomberg News survey.

The ISM’s manufacturing index declined to 60.4 last month from 61.2 in March, the Tempe, Arizona-based group said yesterday.

Credit Suisse cut its estimate of China’s economic growth for this year and 2012 after the nation’s Purchasing Managers’ Index slipped to 52.9, below the median forecast of 53.9 in a Bloomberg News survey of 20 economists. The country is the world’s second-largest crude-consuming nation, after the U.S.

Source : www.bloomberg.com