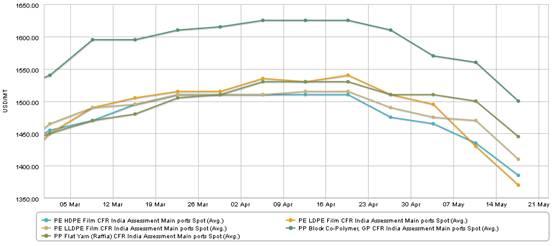

Opportunities to export polyethylene (PE) and polypropylene (PP) east from Europe are beginning to dwindle as Asian prices slip in the face of weak demand and imminent new capacities, market sources said on Monday.

European polyolefins, beset by poor demand in 2009, had been strongly supported by exports to Asia over the past three months.

“We have sold record export volumes in May,” said one major European PE producer. “We should be ok in Europe if people keep exporting.”

Asian PP prices of $1,000-1,060/tonne (€710-753/tonne) CFR for homopolymer PP injection, meant that earlier free on board (FOB) levels of $980/tonne from major northern European ports were no longer workable.

The $40/tonne price reduction in Asian PP was exacerbated by the weakening dollar.

China’s high import volumes in the first four months of the year indicated that inventories were now high, and that importers were now pushing for lower prices.

“Our biggest concern at the moment is our ability to export beyond June,” admitted another major European PE producer, who had also been enjoying strong export activity.

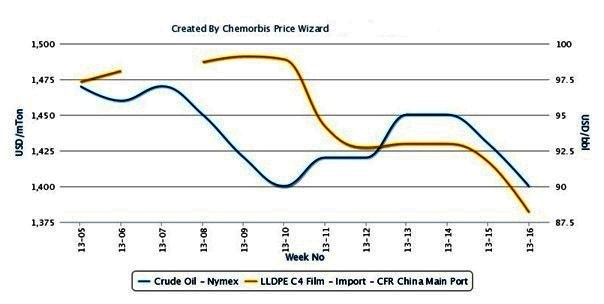

June export volumes were still good and plants were running hard to fulfil the commitments taken on this month, several producer sources said, but new capacities were due on stream in Europe, Asia and the Middle East, and buyers were cautious.

Most of the new plants that were due on stream were planning to export most of their material to Asia, but the volumes arriving on stream were hefty, and even if product did not arrive immediately in Europe, exports would be displaced, sources agreed.

Several large PP and PE buyers expressed frustration that they had not been offered any real quantities from the new Middle Eastern capacities in particular.

“I have been told by one supplier not to expect anything before quarter three,” said a large European PP buyer.

Those producers who had a foot in both the Middle East and Europe stressed that they did not intend to flood Europe with material from new capacities, but acknowledged that the current export spree would come to an end.

“I think we will be ok in quarter three, but by the fourth quarter there will have to be some impact from all the new capacities,” said a polymers producer with production both in Europe and the Middle East.

Most sources agreed that much would depend on the level of demand in Asia, but with prospects low for 2009, and around 11m tonnes of polymer capacity due on stream from China and the Middle East by the end of 2009, they admitted that the effect from new plants was simply a matter of time.

PP and PE producers in Europe include LyondellBasell, Borealis, SABIC, Total Petrochemicals, Dow Chemical, Repsol, INEOS, Polychim and Domo.

Source: worldscrap.com