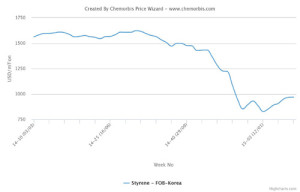

In Asia, there are several PVC shutdowns during the June-October period which are expected to help balance the weak demand for PVC. This week, players operating in China’s and Southeast Asia’s PVC markets have reported more or less steady PVC offer levels as per ChemOrbis pricing service.

Looking at production news, Junzheng Chemical shut their 320,000 tons/year PVC plant in Inner Mongolia on June 12 for a turnaround. The duration of the shutdown has not been disclosed. China General Plastics Corporation’s 170,000 tons/year Taiwanese PVC plant is to be shut for a month during June and July.

Chinese Yili Nangang Chemical also shut their 120,000 tons/year PVC plant on June 25 for a month-long maintenance. Taiyo Vinyl will shut their 150,000 tons/year PVC plant in Osaka, Japan during July and August while the company will shut their 100,000 Chiba PVC plant during September-October, again for a month. Indonesian Standard Toyo is also planning a shutdown at their 87,000 tons/year PVC plant between July 11 and 25.

In the upstream markets, Taiwan VCM is to shut their 382,000 tons/year VCM plant in early July for 2-3 weeks. Formosa Plastics is also planning a maintenance shutdown at their Mailiao VCM and EDC plants with 800,000 tons/year and 1.1 million tons/year capacities, respectively during July and August. Apart from these plants, Finolex Industries has already shut their 130,000 tons/year VCM plant located in India in May due to a feedstock shortage. The plant is expected to remain off line until September 15-20.

A Chinese producer commented, “Prices in the local PVC market have started to rebound a little due to the maintenance shutdowns. Therefore, we have witnessed relatively better trading activities compared to last week.”

A trader operating in Shanghai said, “Given several PVC and VCM/EDC shutdowns, some producers have started to lift up their ex-factory prices, which caused trade to improve, especially in the local market.”

Another trader remarked that a major Taiwanese producer is not willing to offer discounts on their offers as they will have a maintenance shutdown in July for up to three weeks. “Considering their shutdown, the producer kept their offer levels unchanged to China. We think that the market may record further decreases in the upcoming days given the widespread weak demand comments, but we anticipate the decrease amounts to be smaller on shutdowns,” he further added.

In Southeast Asia, PVC prices were mostly steady with sellers commenting that they are not rushing to reduce their prices. In India, players generally report that overall PVC demand is very weak given the nearing monsoon season and lower operating rates of 40-45% at the country’s pipe manufacturers. A pipe converter and a trader both reported hearing that a Taiwanese major had sold out their July allocations to India. The converter commented, “We heard the producer sold out at around 13,000 tons for July cargoes.”

According to ChemOrbis, a source at a Thai producer noted, “We are offering to the Southeast Asian markets but demand is not healthy. However, I cannot say that demand is at its worst, either. Although buyers keep placing lower bids, we cannot lower our prices more than $10/ton due to our already narrow margins.”