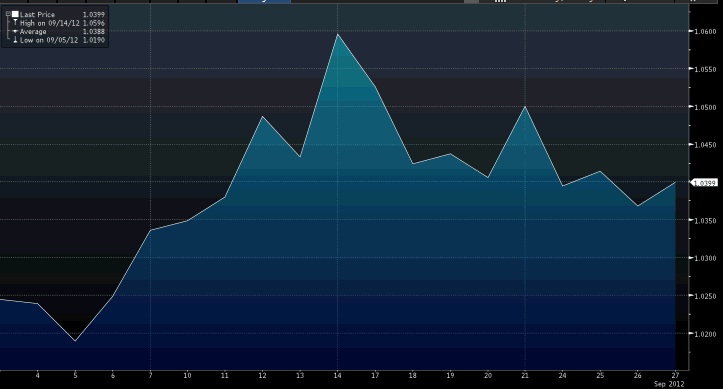

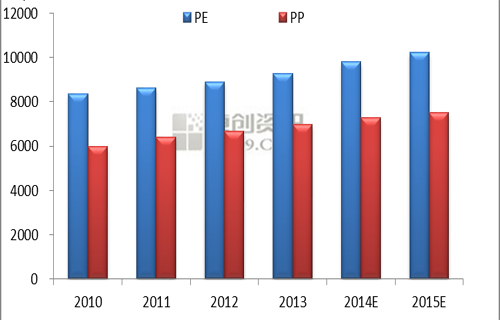

This week sellers have taken a firmer stance in China’s PP and PE markets following the limited activities throughout last week due to shorter working days as per the pricing service of ChemOrbis. Higher crude oil and LLDPE futures markets, as well as, the stable to firmer trend seen in monomer prices provided ground for sellers’ attempts to reverse the market sentiment.

This pushed buyers to seek low priced cargoes in order to replenish some stocks before they disappear, although they remain cautious with their purchases given the lack of revival in end product businesses. This fact is also making many Chinese sellers feel skeptical about the sustainability of the recent firming.In the local PP market, Chinese producers have applied price hikes of CNY50-150/ton ($8-24/ton) as of this week, according to regional players. “Local producers raised their prices citing higher crude oil prices but trading activities are still slow as buyers are still not rushing to secure large volumes,” the distributor commented.

A woven sack manufacturer said, “We received new PP offers from a domestic producer with increases of CNY50/ton from last week. Prices are likely to follow a stable to firmer trend in the short term.”PE players are reporting a similar situation. A distributor who lifted his offers by CNY50-150/ton ($8-24/ton) reported, “We have raised our prices as we are not holding large stocks. However, downstream demand can still be considered weak as many buyers are refusing new purchases beyond normal needs. That’s why we believe that the current firming trend will last only for a short period thanks to local producers’ price hike announcements.”

An agricultural film maker also reported that they received prices with small hikes from last week and they made purchases of local materials in small volumes this week as they feel that PE prices may remain stable to firm due to high oil prices and firming LLDPE film future prices over the near term. However, he underscored, “Our purchasing volumes are not large as demand remains insufficient for our film applications.”In the import market, an Indian producer raised its homo PP prices to China by $25/ton for June shipments.

Import PP offers from traders for many other origins are steady to firm this week since they are also trying to raise prices due to higher domestic prices, but trading is slow at the higher prices, they admit.According to ChemOrbis, a trader offering several PE cargoes on a stable to firmer note in the import market said, “Firming oil prices and rising LLDPE film future prices have supported the market sentiment and encouraged some converters to buy some volumes. However, we have no intention of replenishing stocks in large tonnages for now as we are doubtful about the sustainability of this rising trend in the midst of a lack of a clear revival in end demand.”