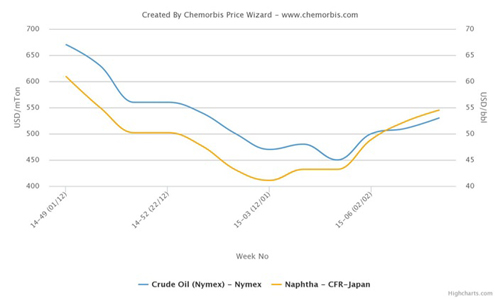

Oil prices rose on Wednesday as gains in the stock market outweighed rising inventories in top consumer the United States.

U.S. crude settled up 30 cents at $48.85 a barrel, after trading down to $47.70 earlier. London Brent crude settled 1 cent lower at $49.81 a barrel.

Oil rebounded in late activity as the U.S. stocks got a boost after several corporate executives gave positive outlooks, easing recession concerns.

“The oil market refuses to go lower despite terrible inventory data,” said Tom Bentz, analyst at BNP Paribas Commodity Futures Inc. “This has been the case for months. And the stock market is still holding.”

The slumping economy has sapped demand and dragged crude off record highs over $147 a barrel in July, causing inventories to swell.

U.S. crude stockpiles jumped by 3.9 million barrels last week — above analysts’ expectations — to hit a fresh 19-year high, according to the U.S. Energy Information Administration. Product inventories showed a surprise build.

“The market is pretty well supplied,” said Amanda Kurzendoerfer, commodities analyst for Summit Energy. “It seems like we keep getting confirmation of that week after week.”

In addition, oil stored at sea by companies has risen to 100 million barrels, the highest level in recent times, according to Frontline (FRO.OL), one of the world’s biggest independent oil tanker owners.

Early pressure on crude came after the International Monetary Fund predicted the global economy will shrink by 1.3 percent in 2009. In January, the organization had forecast global growth of 0.5 percent this year.

“Arguably the biggest uncertainty in the oil market at the moment is the economy,” Lawrence Eagles, oil analyst at JP Morgan, said in a research note.

“But even assuming a tentative second-half 2009 recovery, some of the latest bleak demand data suggest that without a further OPEC cut, we may not see a significant stock draw until the fourth quarter of 2009.”

Further support for crude prices came after China’s central bank on Wednesday said the economy of the world’s No. 2 oil consumer is on the road to recovery. Goldman Sachs raised its forecast for China GDP growth this year to 8.3 percent from 6.0 percent on the back of aggressive government efforts to boost investment.

Top Libyan oil official Shokri Ghanem said OPEC is worried about oversupply in the oil market and wants members to comply fully with their output targets.

The cartel last year agreed to a series of production cuts to help support crude oil prices. A handful of OPEC members — Iran, Angola, Nigeria, Venezuela and Ecuador — were still pumping significantly more than their targets in March, according to a Reuters survey.

Source: news.chemnet.com