Spot ethylene bids and offers were far apart Monday while no bids or offers were seen for spot propylene. NGLs traded lower and spot resin trading was moderate.

March ethylene was bid at 23.5 cpp (Wms system) against no offers. April was bid at 23 cpp (Eq, Wms and Choctaw system) and offered at 30 cpp (Eq and Wms system). No deals were confirmed. The last fixed-price transactions were confirmed at 24.5 cpp for March and 24.125 cpp for April.

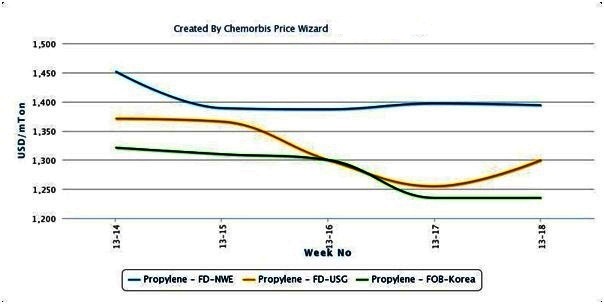

No spot propylene bids, offers or transactions were confirmed Monday. A Friday RGP deal was confirmed at 20 cpp for April delivery via truck. The last confirmed RGP trade was Friday at 19.75 cpp for April delivery. Polymer grade propylene last traded Thursday at 26.1 cpp for March and 25.5 cpp for April.

In production news, several olefins production units remained shut. Markwest’s Javelina offgas facility in south Texas is on track to resume operation Tuesday. Shell’s GO-1 cracker is expected to restart in mid-to-late April. ExxonMobil’s Beaumont olefins unit remains shut and a restart date has not been disclosed. One of Dow’s crackers at St. Charles remains shut as is Chevron Phillips’ Sweeny 22 olefins unit. No restart dates have been disclosed for either unit. Eastman’s 3A cracker at Longview is shut indefinitely.

Energies were mixed and NGLs traded lower. Crude oil fell $3.97 closing at $48.41/bbl. Natural gas was up 11 cents at $3.739/mmBtu. Ethane was a half-cent lower at 31.75 cpg. Propane was down 4.125 cents at 64 cpg. Butane fell 4.25 cents to 82.75 cpg. Iso traded 3.25 cents lower at 99.5 cpg. Natural gasoline tumbled 7 cents to 101.75 cpg.

In the spot resin market, export demand continued to be seen, largely for film grades but also for polypropylene. The material has been destined for China, and also to Latin America. Domestic demand remains poor, traders said, but domestic spot railcars continue to trade as processors search for single railcar lots to supplement lean inventories. HDPE blow mold, HDPE injection and LLDPE film butene remain in the low 40s cpp range. HoPP injection has been trading in the low-to-mid 30s cpp range, with the lower end of the range reflective of bagged material at Houston area warehouses, and the higher end reflecting domestic delivered railcar prices.

Source: petrochemwire.com