Top exporter Saudi Arabia may reduce the official selling prices (OSPs) of September crude for Asian clients, a Reuters poll showed on

Top exporter Saudi Arabia may reduce the official selling prices (OSPs) of September crude for Asian clients, a Reuters poll showed on

Tuesday, as refinery shutdowns in Taiwan, China and India curb demand for Middle East grades.

Two refinery outages and planned repairs at a third plant have bolstered the bearish outlook for the region’s heavy sour crude, which constitutes the main feedstock in all three cases.

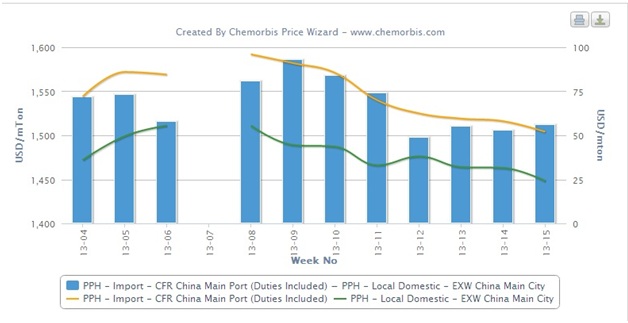

As recently as last week, some traders had expected prices for Saudi Arabia’s lighter grades to track rising values for rival Russian ESPO crude. But weaker Dubai swaps and fuel oil cracks were now likely to prevail instead, said seven polled traders, some of them at companies that buy Saudi crude.

The biggest decline was expected for Arab Heavy, which would drop by as much as 60 cents, the poll showed, compared with an average decline of 20 cents for Arab Light. All traders agreed the spread between sweet and sour grades would widen because of stronger naphtha cracks and attractive gas oil margins.

“With the refinery shutdowns, overall crude market sentiment is quite weak, so they cannot ignore this kind of sentiment even though gas oil and naphtha cracks are quite supportive,” said a trader with a northeast Asian refiner of Saudi crude.

State oil company Saudi Aramco last month raised the price of Arab Heavy by a much larger than expected 75 cents.

Taiwan’s Formosa Petrochemical Corp shut its 540,000 barrels per day (bpd) refinery in Mailiao, Asia’s fifth-largest, following the seventh fire in a year on Saturday. The plant will remain closed for at least two weeks, and any restart will be subject to government approval.

Formosa has put in requests to defer August term crude supply from Saudi Arabia and Kuwait, but has yet to receive a confirmation, a trade source said. The company could resell spot Oman and Basra Light cargoes, sources said.

“It’s bearish news for the market,” said a trader with another major northeast Asian refiner.

Following news of the Formosa outage, the discount of front-month September Dubai swaps to October swaps widened by 8 cents to 25 cents a barrel, Reuters data showed.

This market structure denotes ample supplies and is known as contango, which makes Saudi OSPs more prone for a cut.

In China, the shutdown of a 200,000 barrel-per-day crude distillation unit at PetroChina’s Dalian refinery may last for another two weeks or longer after a fire on July 16, reducing the plant’s operations and possibly causing a delay in receiving foreign crude cargoes.

In India, Reliance Industries, owner of the world’s biggest refining complex, plans to shut two secondary units at its new 580,000-bpd Jamnagar refinery in September.

The Saudis have not let up efforts to sell more oil in Asia as they ramp up output to near 10 million bpd for the first time since 2008, coinciding with the International Energy Agency’s release of 60 million barrels of oil from emergency stockpiles.

Saudi crude OSPs are usually released around the fifth of each month, and set the trend for Iranian, Kuwaiti and Iraqi prices, affecting around 8 million barrels per day (bpd) of crude bound for Asia.

State oil giant Saudi Aramco sets its crude prices based on recommendations from customers and after calculating the change in the value of its oil over the past month, based on yields and product prices.

Source : english.alarabiya.net