• Borealis announces a net profit of EUR 61 million

• Successful completion of Borouge 1 and 2 turnarounds

• Acquisition of DEXPlastomers completed

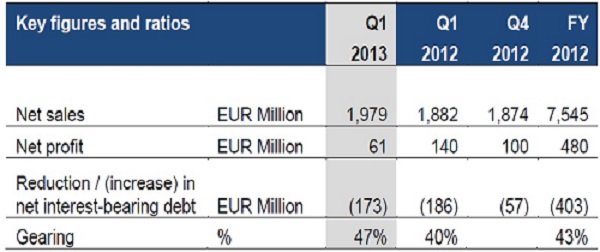

Borealis, a leading provider of innovative solutions in the fields of polyolefins, base chemicals and fertilizers, announces a net profit of EUR 61 million compared to EUR 140 million in the same quarter in 2012. The decrease in net profit was a result of lower sales volumes and profits in its joint venture, Borouge, due to a planned turnaround for routine maintenance, as well as soft market conditions for the European Polyolefins business. The Base Chemicals Business Group including fertilizer continued to perform well and delivered results above the same quarter of last year.

Borealis, a leading provider of innovative solutions in the fields of polyolefins, base chemicals and fertilizers, announces a net profit of EUR 61 million compared to EUR 140 million in the same quarter in 2012. The decrease in net profit was a result of lower sales volumes and profits in its joint venture, Borouge, due to a planned turnaround for routine maintenance, as well as soft market conditions for the European Polyolefins business. The Base Chemicals Business Group including fertilizer continued to perform well and delivered results above the same quarter of last year.

Net debt increased by EUR 173 million, driven largely by the acquisition of DEXPlastomers and a dividend payment to Borealis’ shareholders. Borealis’ financial position remains strong with financial gearing at 47% at the end of the first quarter.

Semi-commercial catalyst plant in Linz, Austria

The start-up of the new semi-commercial polyolefins catalyst plant progresses well, with multiple batches of catalyst successfully tested through the company’s polymer lab and pilot plant facilities. Preparations are underway to commence the qualification process at Borealis’ key commercial production facilities during the second quarter of 2013. The second line within the catalyst plant, which will focus on the development of new catalysts, was completed during the first quarter of 2013.

Borouge turnaround and expansion

Borouge, Borealis’ joint venture in Abu Dhabi, has safely completed scheduled turnarounds at its Borouge 1 and Borouge 2 crackers and polyethylene and polypropylene plants. All the plants have been restarted successfully after the turnaround and production levels have returned to normal.Borouge has entered the final preparation phase for the start-up of its Borouge 3 expansion which will increase the annual production capacity of the company’s integrated polyolefin site from the current 2 million tonnes to 4.5 million tonnes by mid-2014. Over 23,000 contractors and sub-contractors remain involved in the construction work in Ruwais.

The new Borouge Innovation Centre in Abu Dhabi will be completed in 2013 to further support Borouge’s value-creation approach and help develop innovative plastics solutions to meet all customers’ requirements.To further prepare the company for its expansion, Borouge announced that it will open five new sales offices throughout Asia.

Acquisitions in fertilizers and plastomers

In February, Borealis made a firm offer to French oil and petrochemicals company TOTAL to purchase all outstanding shares of GPN SA, France’s largest nitrogen fertilizer manufacturer. Coinciding with its bid for GPN, Borealis made a firm offer to TOTAL for its entire 56.86% interest in Rosier SA. Rosier is a mineral fertilizer manufacturer with two production facilities in Moustier, Belgium and in Sas van Gent, The Netherlands.

In early March, Borealis announced that it had completed the acquisition of DEXPlastomers VOF in Geleen, The Netherlands, from DSM Nederland BV and ExxonMobil Benelux Holdings BV. DEXPlastomers was a 50/50 joint venture ultimately owned by Royal DSM and ExxonMobil Chemical Company and has since been renamed Borealis Plastomers.

The products manufactured in Borealis Plastomers are specialty products, complementary to Borealis’ current innovative plastic solutions. The acquisition underpins Borealis’ commitment to its Value Creation through Innovation strategy and will enable Borealis to provide an extended solution package to existing and new customers. This highlights the significant opportunity available to further grow sales into new relationships. Integration of the new business into the Borealis family is progressing well.

Investments to remain strong in Europe

In January, Borealis announced investment projects in Stenungsund, Sweden and Porvoo, Finland with a combined capital expenditure in excess of EUR 45 million. These projects will strengthen Borealis’ regional supply and support capabilities by driving greater energy and production efficiencies and further refining production output to deliver higher value products.

The company recognises that a continuous drive for higher quality, efficiency, and reliability is essential to maintaining its leading position in the market.

Still expecting challenging years ahead

“Despite the largest Borouge turnaround in its history and a continuation of soft market conditions in European Polyolefins, profits exceeded expectations,” states Mark Garrett, Borealis Chief Executive. “Our Base Chemicals business continued to bring good results confirming our strategy to expand in this area. We will further optimise our European operations in order to be sustainably profitable and to grow in these volatile markets, whilst remaining committed to our long-term winning strategy.”

More Information :www.borealisgroup.com