PP prices in many parts of the world are showing a bullish trend in January in the wake of firmer feedstock costs and limited availability, as per the pricing service of ChemOrbis. Buyers in several regions have also come to terms with the fact that PP prices are not likely to face downward pressure for the near term.

In Europe, players have returned from the Christmas and New Year holidays to see price increases on new January PP offers, even though propylene contracts settled €13/ton lower earlier in the month . A West European producer is seeking a €75/ton increase for January gentlemen’s agreements, reported players in Italy. In the spot market, Italian buyers also reported receiving €50-60/ton higher prices than last month. Even though demand is restrained due to the earlier pre-buying activities, supplies are considered limited across Europe. The force majeure announcement of Ineos on its PP supply out of its Lavera plant has also reinforced the supply concerns recently.

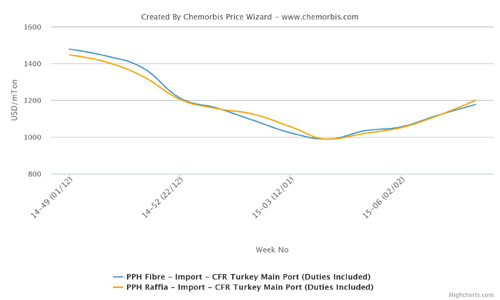

When looking at the Turkish market, this week’s import PP prices from the Middle East appear to have risen by $40-60/ton compared to mid-December. Many buyers also comment, “We don’t foresee a softening on PP prices for the near term given the ongoing strength of the market.” In Egypt, the domestic PP producer applied a three digit increase on its list prices. “This increase should see acceptance sooner or later when considering the globally firming trend,” a company source commented. Main import PP suppliers of these two countries are from the Middle East, where PetroRabigh, Natpet and Borouge are now undergoing PP production shutdowns.

The Chinese market returned from the New Year holiday with new price hikes as well, as per ChemOrbis. South Korean and Indian producers have lifted their offers by $30-40/ton to China, applying a larger increase than that of the Middle Eastern producers in the pre-holiday period. The sentiment has improved in the country in line with the rising crude oil prices, propylene costs and talk of diminishing supplies. Accordingly, a South Korean producer is even said to be planning a new round of price hikes.

When looking at the US market, price hike nominations of 11.5-13 cents/lb ($253-286/ton) for January propylene contracts dragged domestic PP prices higher as well. Formosa Plastics Corporation plans to increase January PP contract prices by 12.5 cents/lb ($276/ton), according to a company statement.