In China, local polymer prices have generally moved lower after the National Day holidays as slower than expected demand, bearish sentiment in other major global markets and volatile upstream costs have pushed buyers to the sidelines, as per the pricing service of ChemOrbis.

A converter manufacturing packaging film commented, “We received offers from domestic producers with decreases of CNY150-300/ton ($24-47/ton) for LDPE and CNY200/ton ($32/ton) for LLDPE this week. We are in no rush to purchase for now as we are not feeling satisfied with our end product business and we believe that prices will continue to soften over the short term.” A distributor based in Ningbo stated, “The offers we received from domestic producers came down by CNY100/ton ($16/ton) for LLDPE film and by CNY200/ton ($32/ton) for LDPE film and we believe that other sellers will concede to price reductions in the days ahead. We are also planning to reduce our prices in order to speed up our sales.”

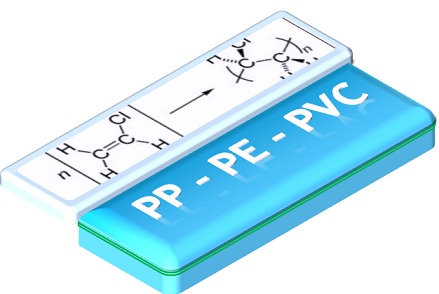

In the PP market, a distributor in Shanghai stated that they reduced their offers for domestic raffia by CNY100-200/ton ($16-32/ton) this week. “We lowered our prices in hopes of enticing greater buying interest as most buyers are sticking to the sidelines for now given the volatility in upstream markets,” the distributor reported. Another distributor added, “The offers we received for domestic PP are stable to softer when compared with the pre-holiday period. Some sellers have conceded to reductions on their prices as they are not feeling confident about the market direction.” A converter manufacturing woven sacks stated, “We received stable to softer homo-PP prices this week even after the spike in crude oil prices seen on Tuesday. We are only purchasing according to our needs for now and are tracking movements in upstream costs as well as domestic producers’ price announcements to get a better idea of the likely direction of the market.”

A source at a domestic ethylene based PVC producer told ChemOrbis, “We lowered our prices by CNY100/ton ($16/ton) to the local market while cutting our export prices by $10/ton. Our sales are not very encouraging this week as many converters had stocked up some material before the holidays and we are also seeing weaker demand from our major export markets such as Southeast Asia.” A plastic pipe manufacturer reported, “Domestic PVC prices are stable to softer when compared with the week before the holidays. We are in no rush to purchase for now as it is now the slow season for many PVC applications.”

A source at a B-grade PS producer stated that they reduced their prices by CNY300/ton ($47/ton) for GPPS and by CNY400/ton ($63/ton) for HIPS this week. “We lowered our prices due to declining market prices and poor buying interest,” the source commented. A toy manufacturer based in Shantou commented, “The offers we received for domestic PS and ABS moved lower this week as some sellers implemented reductions on their prices to speed up their sales. We are not looking to make any purchases until we have a clearer idea about the likely direction of the market.” A distributor based in Ningbo reported, “We received offers from a domestic A-grade producer with rollovers for GPPS and CNY200/ton ($32/ton) declines for HIPS. Demand is not very strong these days and we are only able to make sales in small tonnages. We think that prices will remain on a stable to softer trend over the near term.”