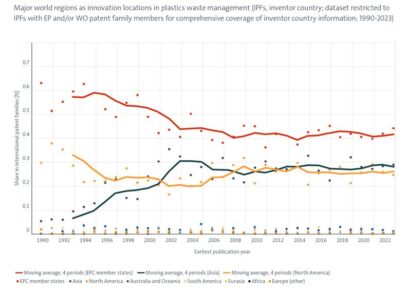

Europe has been the top innovator in plastic waste management for the past three decades, a new report by the European Patent Office (EPO) reveals.

Data shows that innovation in plastic waste management has outpaced other technology fields, with patenting activity increasing 18-fold during the period from 1990 to 2023. The growth in applications intensified after 2015 and rapidly accelerated in the 2020s.

Artificial Intelligence (AI) has emerged as yet another leading area for European technology in plastic waste management.

The report identified a total of 85 unique inventions related to plastics waste management equipment and processes. The first observations related to AI for plastics waste management are visible from the mid-1990s onwards, and after 2016 all years show activity in AI patenting. More than 90% of all AI-related inventions took place after the mid-2010s.

With 39.7% of the total, the European countries are the leading applicants for AI inventions, followed by Asia with 23.9% and North America with 26.1%. This European leadership is even more pronounced in the boom years of the 2020s.

Analysis shows that most AI innovations focus on optical sorting and separation methods, followed by collecting in general, and mechanical processing of used plastics.

Top countries

The top countries for patenting activity in plastic waste management in 2023 were the US with 22.99% of total patents, Japan 14.31%, Germany 14.25%, France 4.94%, Italy 4.65%, China 3.93%, UK 3.73%, South Korea 2.46%, Austria 2.35%, and Netherlands.

Europe remained the undisputable leader in plastic waste management in 2023, with 43% of patent applications. Asia (27%) overtook North America (25%) for the first time.

The old continent shows a focus on macroplastic processing and on mechanical and physical methods (e.g. density-type separation, washing), reflecting a strong emphasis on traditional technologies. Asia is highly specialised in chemical methods (e.g. extraction, catalytic cracking) and advanced technologies (such as irradiation), indicating a focus on novel and highly efficient processes. North America relies on chemical and energy-intensive processes (e.g. hydrolysis, oxidation), but also on high-value applications and niches (such as healthcare and nanoplastics) and appears to prioritise market-oriented knowledge, the report says.

Top companies

Eight of the top 20 applicants in plastic waste recycling are European, as are 10 of the top 20 applicants in plastic waste recovery. The three companies focusing solely on recycling appearing on both rankings are all European: Erema (Austria), Carbios (France), and Tomra (Norway).

The top 20 applicants in plastic waste recovery operate in a wide range of industries, with approximately half being headquartered in Europe.

The chemicals industry is the most represented (Solvay, Nitto Denko, Bayer, Eastman, BASF, Borealis, LG Chem), followed by packaging (Krones, KHS, Sidel), consumer goods (P&G, Unicharm), electronics (Panasonic, Edwards) and tyres manufacturing (Bridgestone, Michelin). The list is completed by Tomra, Mitsubishi, DNP (printing) and the Fraunhofer Gesellschaft.

Most top applicants focus on similar recovery technologies, such as washing and cleaning, selective dissolution, recovery through density and gravity, and mechanical methods.

The top 20 applicants in plastic waste recycling include eight of the top applicants in waste recovery, with all top five applicants in waste recycling featuring in both rankings. The chemicals industry (Eastman, BASF, Sabic, Borealis, Dow, DuPont, Bayer, Arkema, Nan Ya Plastics) and the tyre industry (Michelin, Bridgestone, Goodyear) alone provide twelve of the top twenty.

Chemolysis (solvent-based recycling) and mechanical processing are the most patented technologies by the most active applicants. Pyrolysis and depolymerisation can be observed only in subsets of the top applicants, with some patterns of specialisation. Eastman is particularly strong in pyrolysis, while Carbios is a strong leader in depolymerisation . The top applicants’ patenting activities in postconsumer recycling are mainly focused on automotive (with strong contributions from tyre manufacturers Bridgestone and Michelin), packaging, and electronics.

New technology platform: plastics in transition

EPO’s report provides explores five decades of technology trends in plastic waste management based on 12,924 unique inventions in waste recovery and waste recycling. It also offers insights into the patenting behaviour of large applicants in the field, as well as of emerging startups and the research sector.

The association provides several technology platforms that make it easier for scientists and researchers to explore its Espacenet database, which is the world’s largest, freely accessible single source of patent information.

Its latest technology platform – ‘Plastics in transition’ – maps technologies in plastic waste recovery, plastic waste recycling and alternative plastics, using the expertise of patent examiners from the EPO and national patent offices to provide 70 searchable technology areas. By doing so, the EPO aims to increase the accessibility of patent knowledge and further drive innovation in these fields.

The EPO is also making it easier to identify Europe’s investment-ready startups and leading universities in the field. Its free Deep Tech Finder tool has been updated to include the profiles of 145 European startups and universities, which account for 306 European patent applications in the areas of plastic waste recovery, plastic waste recycling, and alternative plastics.

Patent data shows some growth in the startup and university sector. From 2010 to 2023, 82 startups and 63 universities from across Europe filed European patent applications mainly in advanced recycling methods, with a steep rise after 2015. Waste removal technologies saw fewer filings, especially amongst startups, highlighting technical and economic challenges. The startup rankings are topped by companies from the UK, followed by France, Germany and Sweden. Amongst the most active universities in the field are those from France and Germany, which are the top applicants.

Source: sustainableplastics.com